A self-directed IRA is actually a kind of specific retirement account that allow's you invest further than standard shares and bonds. It truly is predominantly utilized by traders who want far more Regulate in excess of their retirement savings and they are at ease handling alternative investments them selves.

In case you Unquestionably needs to have a gold IRA, we’ve damaged down the best options available to you. But remember to bear in mind that even the best of this bunch are certainly not optimum investments on your hard-attained retirement dollars.

Nonetheless, we would not endorse this special kind of specific retirement account for some investors. For example, you received’t find a gold IRA option at any of the most important, most dependable brokerage corporations.

To open up a self-directed IRA, the IRS necessitates you to undergo a custodian who will maintain the account. Custodians of SDIRAs are frequently financial establishments or trust organizations, as well as their part is to make sure the account entrepreneurs observe IRA procedures, including the once-a-year contribution Restrict and reporting towards the IRS.

And eventually, be sure to verify the popularity of any Gold IRA firm’s you may well be contemplating, with 3rd party recommendations and reviews, along with by buyer overview web-sites such as the BBB and industry relevant watchdogs just like the American Numismatic Association as well as the Business Council for Tangible Assets.

Disqualified Individuals A disqualified individual refers to anyone with whom a SDIRA simply cannot location investment dollars. These include things like the SDIRA owner’s fiduciary or close relatives such as partner, ancestor, kid, and husband or wife’s baby.

Blueprint is definitely an unbiased publisher and comparison service, not an investment advisor. The knowledge delivered is for instructional purposes only and we inspire you to hunt personalized assistance from skilled gurus concerning particular financial or professional medical choices. Specific effects may possibly vary. Earlier overall performance just isn't indicative of future outcomes.

Check out a lot more homeownership resourcesManaging a mortgageRefinancing and equityHome improvementHome valueHome insurance coverage

The IRA account itself is effective at Keeping any IRA-authorized precious metals and items. The metals involve; gold, silver, platinum and palladium as well as the products and solutions contain the following:

For most of us, the investments out there with a standard IRA or Roth IRA will fit your preferences with no pitfalls that come with managing a self-directed IRA.

to you.2 That’s a bad point, due to the fact now many of the assets with your account will most likely be matter to taxes without delay. Market place chaos, inflation, your long why not try here run—get the job done which has a pro to navigate these items.

you’ve maxed out your regular retirement accounts and also you’re entirely debt-cost-free (Which means your own home is paid out off too). And bear in mind any rental income generated by the assets doesn’t go on your financial institution account—it goes straight into your self-directed IRA and wishes to stay

Self-directed IRAs are matter to the exact same withdrawal rules as other IRAs: You’ll owe taxes on any money that hasn’t been taxed just before, except for earnings within a Roth account.

the IRA until you’re 59 one/two a long time outdated (Except you ought to get hit with taxes and early withdrawal penalties). And we advocate that you just only purchase a rental property Should you have the money available to order it—no exceptions! But Even when you

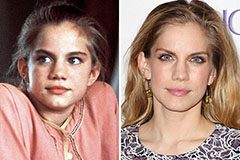

Anna Chlumsky Then & Now!

Anna Chlumsky Then & Now! Mike Vitar Then & Now!

Mike Vitar Then & Now! Tiffany Trump Then & Now!

Tiffany Trump Then & Now! Batista Then & Now!

Batista Then & Now! Lucy Lawless Then & Now!

Lucy Lawless Then & Now!